Baby Boomers may recognize the old 1964 Rolling Stones’ song, “Time Is On My Side,” but when it comes to people who are approaching retirement, they should start humming another tune.

That’s because with the huge losses in both home prices and in their equity portfolios, anyone approaching retirement should be trying to recoup their losses as fast as possible. But the basic mathematics of finance is against that. Here are two examples using the decline in home prices and losses in an S&P 500 portfolio which show that recouping losses is primarily a matter of time.

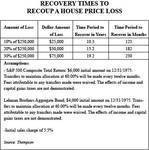

If you paid $250,000 for a house and suffered a 20% loss, it would take you 15 years and two months to recover the loss. If that loss was 30%, you need a little more than 19 years to get back to even (see chart below.)

Aside from these losses, the other problem with housing is that there are so many houses on the market now, especially due foreclosures that the normal evolutionary real estate cycle of people becoming empty nesters or simply moving into bigger or smaller houses. All of this only adds to the inventory. One economic consulting firm has estimated that there is over an eight-year backlog of housing stock in Florida.

Years to Recovery

Here something else which shows that time is not on your side: If you owned an S&P 500 index fund in 2008, that fund fell by 37.5%. To recoup this loss, it would take an investor over five years to recover this loss assuming the traditionally-accepted 9.4% historical rate of return in the S&P 500 Index with dividends re-invested.

Similarly, the time to recover a loss in a home’s price can often be measured in decades. This chart shows the duration of a few price recovery scenarios.

So that’s the one-two punch for the children of the Greatest Generation: significant losses in home prices and equity portfolios that only time can repair.

Maybe this is what people meant when they said “time is money.” But for too many people approaching retirement, time is often an option that many people don’t have.