The prospect of higher interest rates and sustained market volatility as the Fed starts to change direction from its historic policy of Quantitative Easing (QE) should raise a caution flag for investors who want to protect their portfolios. Recognizing this is the easy part.

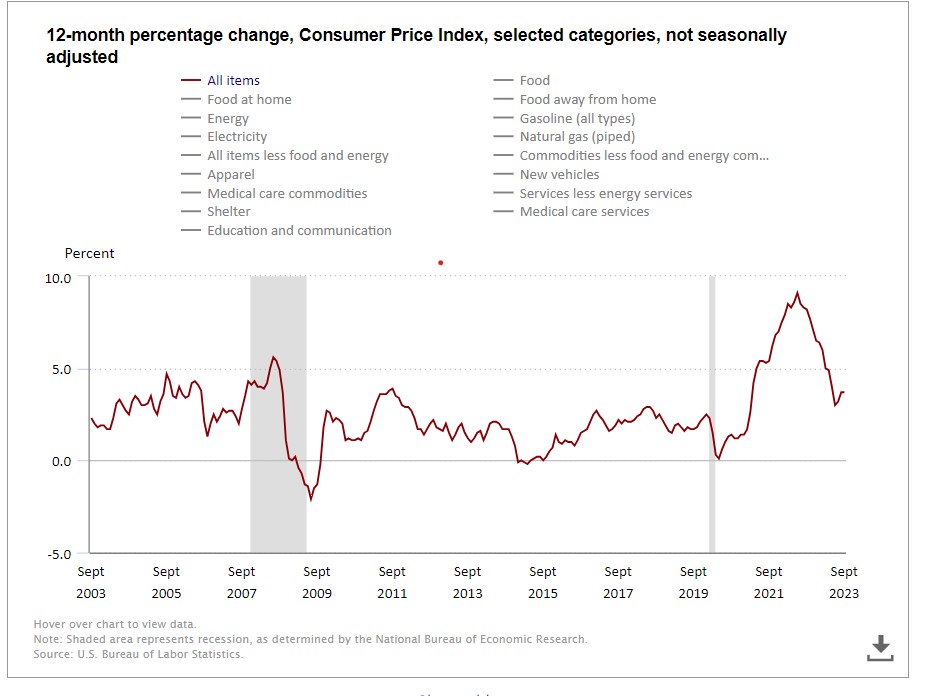

Consumer spending is often tied to increases and decreases in inflation. Inflation is now at about 3.4%. For inflation to hit the Fed’s 2% level, consumer spending has to drop.

The Fed’s interest rate policy affects some key factors affecting households. Interest rates on personal loans have risen from 8.73% at the beginning of the Fed rate hikes in 2022 to 12.17% in August 2023. So, because the direction of rates is uncertain as the Fed pursues its goal of cutting inflation, investors have to devise a plan to protect their portfolios and then execute it.

That’s where most investors lose sight of what they are doing.

It’s also important to note that there is no immediate connection between rising rates and inflation. The two are related, but inflation, which carries a distinct set of other serious problems, develops over a much slower time frame. Still, if you are worried about market gyrations due to rising interest rates, stomach acid may be nature’s way of saying it is time for a change.

Defensive Positions During Inflation

The S&P 500 fell for three consecutive months, from August through October 2023, with a rise in longer-term market rates.

For portfolio relief in times of rising rates, investors have traditionally headed for defensive positions in stocks that are part of life’s basics: utilities, oil, real estate, food, beverage, tobacco, consumer staples, and pharmaceuticals.

These stocks are in non-cyclical stock sectors and often do not do as well in an appreciating market. Still, they can deliver better protection in a rising rate environment since they usually comprise life’s staples. Banks also work well in a rising rate environment, as they can increase profits by lending at higher rates.

Water, gas, and electric utilities are also deemed defensive stocks since they focus on housing requirements. REITs are also significantly appealing if they are invested in moderate-income housing instead of high-end rentals.

Another favored traditional sector has been gold. But aside from jewelry, gold as an investment has been the conventional refuge for investors seeking to hedge against inflation, but gold comes in many forms, and each carries its risks. Physical gold (bullion and coins) is less liquid than investing in gold stocks or ETFs. If you buy large quantities of gold, it has to be stored, and there is a fee for that. While gold prices tend to rise in inflationary conditions, the price of gold is also driven by supply and demand. And because so much gold is available from Russia, China, and Taiwan, prices have suffered.

Poor Investments in an Inflationary Environment

Finding protection in a rising rate environment is challenging, but some safe havens exist. Given the slowly recovering housing market and price and mortgage rate volatility, a rate rise will force more people out of purchasing and into rentals.

With the 30-year mortgage at 7.7% as of November 2023, new buyers face some of the highest rates since August 2021.

As new home purchases soften, home improvement stores should also be weaker performers. For instance, the ETF tracking real estate companies (trading under the ticker symbol IYR) was trading at 78.83% in November 2023, a level hit in October 2022. as rates increased. During this same period, the yield on the benchmark U.S. 10-year note, a good gauge of the direction of mortgage rates, hit its highest level in five years on November 2023.

Defensive Stocks and ETFs

The characteristics of defensive stocks are that they have low price-earnings (P/E) ratios compared to cyclical stocks throughout a business cycle. These stocks also have a low beta, or relative risk and performance to the market, which means they tend to perform better than cyclical stocks in bad times. In a boom part of the business cycle, defensive stocks are not as attractive to investors since defensive stocks rarely tend to see high rates of organic growth.

Some of the better-performing defensive ETFs are VDC (Vanguard), XLP (SPDR), FSTA (Fidelity), IYK (iShares), RSPS (Invesco), and KXI (iShares).

Defensive Bonds and ETFs

For the fixed income part of your portfolio, the easiest and safest way to play rising rates is through a laddered bond portfolio. Bonds should also be considered if you want protection. The best strategy here is to “ladder,” or stagger, the maturities of the bonds in increments of 1-5 years, for instance.

This strategy gives you exposure to different points in the yield curve, and as rates increase or decrease throughout your bond exposure, you get some price protection if rates become volatile.

There are a few ways to build a laddered bond position. One is in the cash market. Bonds are purchased in increments of $10,000. But if that is too pricey, consider a bond mutual fund, which often mixes different grades of corporate bonds and maturities. For more prudent investors, move to a government or a municipal bond fund. Of course, the trade-off here is that you will protect your principal or original investment amount, but you will only earn the prevailing interest rate.

A third way is through exchange-traded bond funds (ETFs.) Various managers offer laddered bond ETFs with an extensive corporate and high-yield bond portfolio. The benefit is that the laddered bond positions are in a single EFT, making them easy to purchase and monitor. Holding a more extensive portfolio of bonds contained in an ETF is beneficial since it spreads the rate risk and this is more easily done in mutual funds or ETFs than holding individual bonds.

Some of the largest and better-performing bond ETFs are BND (Vanguard), AGG (Blackrock), BNDX (Vanguard), and TLT (Blackrock).

The Impact of Inflation

The cascading effects of high inflation erode living standards, causing artificially high corporate profits and rising interest rates. Higher rates contributed to the savings and loan crisis of the early 1980s, which cost taxpayers about $160 billion in payments for federal deposit insurance.

At about the same time, high inflation and loose lending policies wreaked havoc on American farmers who borrowed heavily against the run-up in commodity and farmland prices. Farm foreclosures skyrocketed when rates rose and commodity prices declined in the 1980s. According to economist Robert Samuelson, other similar sad stories link inflation to the Third World debt crisis in the early 1980s and public sentiment against investing in the stock market.

It has been almost 50 years since the U.S. economy began an economic cycle dominated by inflation. Starting in 1960 and ending in 1979, U.S. inflation went from 1.4% to 13.3%. By 2001, it was almost back to where it was in 1960, 1.6%. During this period, inflation affected prices and greatly impacted politics, business, employer-employee relations, global trade, and how American society evolved. Inflation is also tied to non-economic factors, such as price gouging. This happens when wholesalers and retailers raise prices to increase profits but without any underlying increase in prices.

Today, investors should take note of the stronger dollar and its impact on international companies, which could hurt. While many people today do not recall this period, the Great Inflation lasted from about the mid-1960s to the early 1980s. It could be considered the most significant domestic policy mistake since World War II.

While the Federal Reserve’s move away from quantitative easing (it started in 2009 and eventually injected over $3.5 trillion into the financial system by October 2014) may be coming to a close soon, any interest rate increases from these historic lows should not produce the ill-effects seen in the Great Inflation.

But investors should still note that few economies have gone as long as a decade without falling into a recession. When that happens, inflation again becomes a concern. That’s the economic reality, so all investors should plan accordingly.