Crypto regulation anyone?

Definitely not in the gray world of cryptocurrencies and crypto exchanges.

Just like abolishing the carried interest tax loophole is like showing the silver cross to vampires, enacting regulation in the crypto world is a real deal-breaker.

So with the Ukraine invasion as the catalyst to stop Russian oligarchs from moving and laundering their money via crypto a real event, Senator Elizabeth Warren (D-Mass.) wants to enact legislation that would, among other things, prevent transfers of over $10,000 in crypto without identifying the account owners.

As the Boston Globe reported, the proposed legislation “would grant the Treasury Department the authority to prohibit cryptocurrency exchanges under US jurisdiction from processing transactions involving addresses affiliated with Russians and would give the president the authority to apply secondary sanctions to foreign exchanges that do business with sanctioned people, companies or government entities, according to Warren’s office.”

A provision of the bill would force Russian oligarchs and those connected to Russian President Putin to reports crypto transfers of over $10,000 to the Treasury Department’s Financial Crimes Enforcement Network.

The proposed legislation is sponsored by Democrats. No Republicans have so far signed on to the proposals, which is not unexpected. Republicans hate all forms of tax and business regulations, especially those that affect the well-funded financial lobby.

Recently, the crypto world has gotten more aggressive in its lobbying, regulatory judo, and PR campaigns, by sponsoring ads in the Superbowl and spending millions on lobbying efforts. The industry’s goal is to remain a money laundering and unregulated speculative game for many unsophisticated investors, who are being told that crypto is an asset class, a hedge against inflation, and viable addition to a diversified portfolio. All of those are lies.

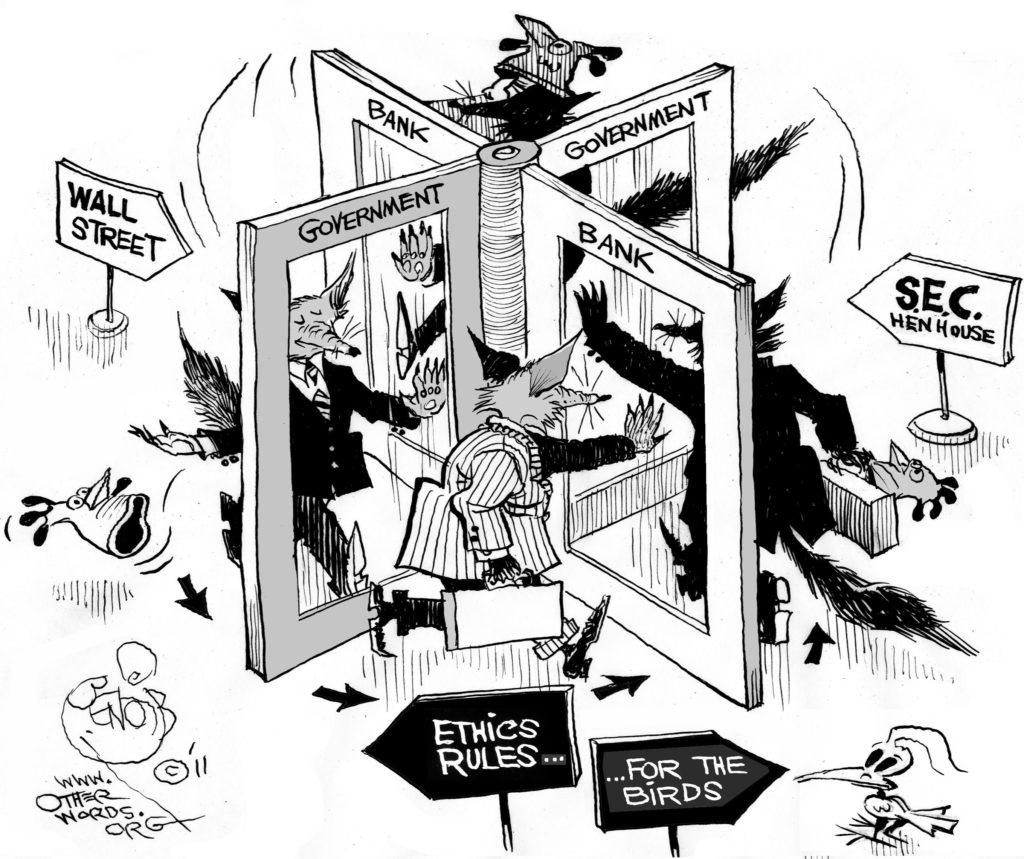

To push their gray agenda, the industry is paying big money to some revolving-door federal regulators, akin to white-collar mercenaries, who work both sides of the fence, depending on who is paying them. Among them are former CFTC regulator Brian Quintenz,  who joined Andreessen Horowitz, a venture-capital firm and an investor in crypto startups; Jay Clayton, the previous head of the Securities and Exchange Commission; Brian Brooks, who ex-acting Comptroller of the Currency; Chris Giancarlo, a former head of the CFTC; and in the UK, Philip Hammond, a former chancellor of the exchequer, according to The Economist.

who joined Andreessen Horowitz, a venture-capital firm and an investor in crypto startups; Jay Clayton, the previous head of the Securities and Exchange Commission; Brian Brooks, who ex-acting Comptroller of the Currency; Chris Giancarlo, a former head of the CFTC; and in the UK, Philip Hammond, a former chancellor of the exchequer, according to The Economist.

Lobbying Against Crypto Regulation

It is also spending big on more lobbying. The Washington Post reports that crypto lobbyists spent $2.8 million in 2020, and increased that amount to $4.9 million through the first nine months of 2021, according to figures from the Center for Responsive Politics.

No doubt the crypto lobbying group, the Crypto Council for Innovation, opposes most forms of regulation as an assault on “innovation.” As one of their first PR forrays, the Council responded to federal officials who said crypto is being used for illicit financial activities.

In response, the Council’s Michael Morell, former Acting Director, Deputy Director, and Director of Intelligence at the Central Intelligence Agency, headed a team which refuted “the general assertion that the Bitcoin market is rife with illicit activity. Morell concludes that Bitcoin’s use in illicit finance activity is limited and orders of magnitude lower than what has been cited by government officials.”

While the group disputed the extent of crypto fraud, it also said it was much easier to trace fraud and criminal activities via blockchain analysis. The Council, which is oddly heavily comprised of former intelligence, US State Department, and federal financial market regulators, has not issued a response to Senator Warren’s proposed legislation. But, based on this report, they should not object to using blockchain to trace any Russian transfers of money via crypto, especially if the embargoes are Russian oligarchs are sanctioned by the U.S. Government.

However, at this stage of crypto’s presence in the financial markets, the heavily-credentialed Council should also address crypto’s more mundane and shaky role as a very speculative investing alternative.

They can issue a report about how it affects average, unsophisticated investors, who are more familiar with Robin Hood day trading scams, and meme stocks. This report should address whether crypto is an asset class, what drives crypto prices, is it a hedge against inflation, and how it is being used as a proxy for gambling and gaming. Also, what use are non-fungible tokens, or are they even connected to the crypto frenzy?

Financial regulators are justified to be concerned about crypto. No one knows who is behind its expansion, and who runs its “exchanges”?

Reality Check: Crypto is Not The Brave New World of Finance

Traditionally, US stock and futures exchanges operated under well-specified regulatory acts. The modern equity markets date back to the Securities Act of 1933 and the Securities and Exchange Act of 1934. These Acts passed after the stock market crash of 1929 that led to the Great Depression. The Commodity Futures Trading Commission (CFTC) was created in 1974 through the Commodity Futures Trading Commission Act, to enforce price transparency and regulated exchanges.

No such regulation exists for crypto “exchanges,” which have stolen the term to gain more legitimacy. There is no transparency for these “exchanges” nor any accountability.

Senator Warren’s proposed legislation is ethically based on preventing Russian oligarchs from war profiteering, tax evasion, and money laundering.

The Crypto Council should not waste its money on high-priced former federal officials who defend oligarchs if the industry chooses to prevent regulatory enforcement or gain any traction on the PR front.

Crypto is popular because we are unfortunately in a neo-liberal era when the financialization of everything is the new normal. Crypto and crypto “exchanges” offer great markets for arbitrage, fee and commission generation, as well as tax evasion and money laundering.

People are buying and selling it and they have no idea why its prices rise and fall. There are no financial balance sheets and fundamentals that allow even the most basic financial Graham-Dodd or supply-demand analysis. Crypto is in the same category today as roulette, and more astute roulette players have better odds, plus they can get a free drink.

Unfortunately, the former CIA and State Department analysts who are part of Washington’s revolving-door titles-for-hire should get on the right side of history regarding Senator Warren’s proposed crypto legislation.

As of today, despite the well-financed hype, crypto is not the engine behind the Brave New Financial World it is touted to be.