Political commentators and the financial media are breathless over the latest economic numbers showing the lowest jobless rate in 49 years. Still, there is a big problem: These are quarterly, short-term numbers, and they do not indicate the financial health of the average American.

If they had had a direct impact, Americans would not have been worried about their ability to retire. Instead, it is the opposite.

As numerous studies have shown, many Americans face a dismal retirement. About 50% of older Americans have nothing in their retirement accounts. A Government Accounting Office report issued in March 2019 found that 48% of Americans over 55 and older saved nothing in their employee-sponsored or IRA accounts. Numerous other similar studies have found the same results over the past decades.

So, when federal agencies report positive statistics about the economy—whether they are about the jobless rate, productivity gains, or wage increases—they fail to show the sharp disconnect between the data that propels the stock market and the majority of Americans who have nothing to gain from these raw economic numbers.

Federal and state economic data take on a life of their own. The financial media widely tout them and incorporate them into political campaign speeches because they provide short-term political adrenaline. For most Americans, the data creates a sugar high that lasts a few days and soon fades away.

The real measure of the average American’s financial condition is not data about jobless rates, changes in GDP or housing starts, but how well are they prepared for retirement.

But these periodic economic data dumps are a distraction. The financial media reports the numbers but does not put them into context for the average American, many of whom essentially work from paycheck to paycheck. According to CNBC, about 59 million Americans do not have three months of cash saved to meet an emergency despite the recent positive jobless numbers.

The objective measure of the average American’s financial condition is not data about jobless rates, changes in GDP, or housing starts but how well they are prepared for retirement. After all, a person’s financial ability to retire with a comparable, slightly lower, post-working living standard represents their net wealth accumulation over an entire working career. After all, the ability to retire with a modicum of financial security is part of the American Dream.

However, retirement readiness studies show a different situation. Numerous retirement readiness studies indicate a bleak future for millions of Americans. And while pundits gloat over the recent, positive economic numbers, they do not affect the long-term ability of many Americans to save for retirement. For instance, a retirement report from the John Hancock annual Financial Stress Survey, found that “slightly more than three-quarters of survey respondents cited lack of retirement savings as a leading factor affecting their stress. Nearly half report they worry about it “a great deal,’ and only 40% expect to retire ‘about when planned.’”

This is the real mirror of how Americans gauge their financial situation, not periodic economic data dumps that fuel the stock market for a few days.

Fed Reserve Policies Against Average Americans

Retirement financial readiness is a marathon that requires a few basic things: wage growth over time, consistent savings propelled by the miracle of compound interest without excessive fees and expenses, and debt management.

The government has a crucial role in managing this, especially in Federal Reserve Board policies, tax actions, and job creation. However, the Fed has often made decisions that are not based on the needs of average workers. Whether political or monetary is an ongoing debate, but the record shows the slant is against promoting wage gains for average workers.

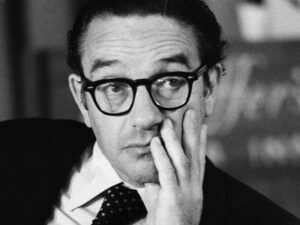

Take the case of how the Fed acted against average Americans during Alan Greenspan’s 14-year tenure as Fed chairman (from 1987 to 2006). His policies were shaped by the belief that any structure or regulation that impedes corporate profits is detrimental to the economy. Regulation and taxes on the rich, in any form, fall under this umbrella. He also opposed the minimum wage and regulatory agencies, such as the Food and Drug Administration, which hinder corporate operations.

However, Greenspan, a follower of Ayn Rand, advocated that practices, such as price collusion, would be permissible since they favorably change market conditions to favor participating corporations. Similarly, monopolies would be tolerated if they competed since they could maximize efficiency and minimize costs and prices. This helps explain why anti-trust laws have not been strictly enforced since 1981.

Greenspan also enacted Fed policies that largely controlled inflation over the other choice of creating conditions that would increase wages. “Greenspan himself observed publicly on several occasions that the anxiety of American workers over losing their jobs was a critical factor in keeping wages down during most of the 1990s,” according to Jeff Faux, president of the Economic Policy Institute.

Building Retirement Wealth is a Marathon

It takes decades, often generations, for the average American to create enough wealth to generate a monthly income. The lost decade of wealth erased from the 2008 recession, combined with the intentional decision to hold down wages during the Greenspan tenure at the Fed, are two main reasons why many Americans don’t have enough money to retire today. Gloating over “Trump’s stock market miracle” is slanted politically and immaterial to most Americans. Yet, the media reports blindly report the data by looking at its apparent mistakes.

The objective measure of American prosperity lies in the boring topic of how to be financially secure in retirement. This is one reason why retirement is rarely discussed in the media. It is depressing and boring, but when done correctly, it will show the flaws in the current unregulated capitalist system. All this would be bad for ratings, but it would be a great public service to a shaky democracy.