How Florida became the outlaw state and home to fraudsters, deposed dictators, tax cheats, and scofflaws

Florida is known for many things ranging from sun and surf to flooded roads during high tides, COVID denial, voter suppression, and its huge business: fraud.

Fraud, considered a white-collar crime, is surging. According to the Federal Trade Commission, consumers reported losing over $5.8 billion to fraud in 2021, a 70% increase over the prior year.

According to white-collar crime statistics, the most common crime is insurance and financial fraud. As of 2022, Florida had the highest number of convicted criminals for money laundering. Based on 2019 statistics, Miami ranked second in the U.S. with 4,237.27 white-collar crimes per 10,000 people. (Richmond, Va. was first.)

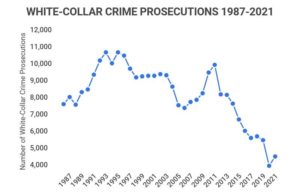

White-collar crimes are very profitable, and the chances of getting away unscathed by law enforcement are increasing. White-collar crime prosecutions decreased by 53.5% from  2011 to 2021. As of 2021, annual losses from white-collar crimes are anywhere from $426 billion to $1.7 trillion. The wide range of failures is due to the lack of prosecutions, according to Zippia.

2011 to 2021. As of 2021, annual losses from white-collar crimes are anywhere from $426 billion to $1.7 trillion. The wide range of failures is due to the lack of prosecutions, according to Zippia.

At the individual consumer level, fraud victims suffer embarrassment, disbelief, and shame about deception. Those are the main reasons why only an estimated 15% of the nation’s fraud victims report their situation to law enforcement, according to the Miami Police Department. Even when fraud is reported, victims of credit card fraud have a one in 1,000 chance of having the crime solved by police.

Fraud is Part of Florida’s History

Florida’s fraud statistics are startling. The numbers are part of the state’s history since the famous Miami land scams that lasted from 1924 to 1926 when unsuspecting buyers from up north bought lots that were underwater. When the land bubble burst, aided by a large hurricane in 1926, it took down local banks, developers, and speculators. Almost 100 years later, Florida remains attractive to white-collar thieves because of its wealth, transient population, and lax enforcement.

Florida’s white-collar criminal history has not evaded its political class. Everyone from governors and local elected officials has benefitted from frauds of all sizes. Today, Governor Ron Desantis has not pulled the welcome mat for fraudsters in the SUnshine state.

The Republican mayor of Boca Raton, Susan Haynie pleaded guilty in 2021 to misuse of public office, public corruption, and failure to disclose voting conflicts, to two commercial real estate firms. Florida Republican Senator and former governor Rick Scott was also the indirect beneficiary of the largest Medicare-Medicaid fraud scheme in U.S. history, a fraud scheme that was settled for $1.7 billion. During the time that the fraud scheme developed, Scott served as CEO and Chairman of Columbia/Hospital Corporation of America.

Today, whether intentional or not, it is difficult to get comprehensive statistics about fraud cases from Florida. The state’s agencies divide their fraud reporting among various departments, ranging from real estate, insurance, financial services, local police, and the Inspector General. When large cases are reported, they often involve the work of federal agencies.

The Most Common Fraud

While Florida is the nation’s third most populous state, it ranks first in the number of fraud reports filed by citizens, according to the site security.org. The targets of fraud are often younger people, but people over the age of 70 reported losing more money. The typical person over age 80 lost $1,500, triple the loss of victims in their 20s, the FTC said in a press release.

The types of fraud most commonly reported in Florida are those related to phony debt collections, identity theft, COVID-related federal fund distributions, impostor scams, credit bureau, banking and lending, mobile phone, and auto-related (fake accidents and inflated repair costs).

The Miami-Ft. Lauderdale-Pompano Beach area, for instance, is the number one location in the nation for mortgage fraud, according to a Q3 2022 study from CoreLogic. This distinction occurred even though the population of Miami is about six million compared to the New York metropolitan area, which has a population of 19 million and ranks fourth in the same fraud data report.

Fraudsters Love Hurricanes and Flooding

But these frauds are petty crimes compared to those involving large property insurance claims due to hurricanes and flooding. The state also has suffered some of the largest scams in U.S. history involving Medicare and Medicaid.

When hurricanes reap their destruction, a second wave of destruction comes from shady contractors and insurance adjusters who work with affected homeowners to inflate repair costs to recover as much money as possible from property insurance companies.

As of 2022, “Floridians pay the highest homeowners insurance premiums in the nation for reasons having little to do with their exposure to hurricanes,” said Sean Kevelighan, CEO of the Insurance Information Institute (III). “Floridians are seeing homeowners insurance become costlier and scarcer because for years the state has been the home of too much litigation and too many fraudulent roof replacement schemes.”

The III also found that 79% of all homeowners insurance lawsuits over claims filed nationwide happen in Florida, even though Florida’s insurers receive only 9% of all U.S. homeowners insurance claims, according to the Florida governor’s Office.

The cost of fraud claims related to hurricane repairs has caused insurer operating costs to skyrocket. This has caused some insurers to cease operations and raise premiums for homeowners.

According to the Florida Office of Insurance Regulation (OIR), $51 billion was paid out by Florida insurers over ten years, and 71% of the $51 billion went to attorneys’ fees and public adjusters, not to contractors who did the work. According to the III, the 2020 and 2021 cumulative net underwriting losses for Florida’s homeowner’s insurers totaled more than $1 billion each year.

All these high costs are passed down to homeowners. The OIR said a typical Florida homeowners insurance policyholder was $2,505 in 2020 and $3,181 in 2021, an increase of 47%, even though the state did not suffer any direct storms over the past three hurricane seasons (2019-2021).

As a result of paying numerous claims, “an unprecedented number” of home insurance companies left Florida or ceased business in 2022, according to Insurance.com. If the state suffers a severe hurricane season, it would prove catastrophic to homeowners and the insurance industry due to the sheer costs of repairs and the incidents of fraud.

Florida Senator Rick Scott: the Posterboy for Medicare Fraud

Former Florida Governor and now Republican Senator Rick set the standard for perpetuating Medicare and Medicaid fraud and walking away a multimillionaire in the process. As chairman and CEO of Columbia Hospital Corporation and the Hospital Corporation of America, the company was the target of the largest Medicare fraud in U.S. history in 1997.

At that time, the Department of Justice won 14 felony convictions and fined the corporation $1.7 billion in the largest healthcare fraud settlement in U.S. history.

When the fraud case was announced, Scott was forced to resign. In the subsequent investigation into the fraud-related failure of the company, Scott pleaded the Fifth Amendment 75 times.

For his part in the fraud, the corporation’s board of directors gave Scott a $9.88 million settlement, accompanied by 10 million shares of stock then worth over $350 million. In 2010, Scott ran for Florida governor as a Tea Party candidate and was elected in 2011. As Scott profited from the Medicare fraud, he set an example for other fraudsters.

“South Florida, without question, is the ground zero for healthcare fraud,” Omar Pérez Aybar, a special agent for the South Florida Health and Human Services Office of Inspector General said. These frauds against Medicare and Medicaid were commonly for medical equipment never delivered to patients. This included ordering everything from the unneeded hip, knee, and back braces to selling Medicare beneficiary data to telemarketers. He added that about 90% of durable medical equipment companies in Florida are fraudulent.

While Medicare and Medicaid are attractive to fraudsters, they are not the only targets. One major fraud in South Florida involved three nursing schools that issued over 7,600 fake nursing diplomas. Another involved distributing over $230 million of adulterated HIV medication. Another man was charged with buying and selling over 2.6 million Medicare beneficiary identification numbers.

Other scams are more sophisticated and involve identity thefts, real estate title frauds, and land, and home misrepresentations.

“Unfortunately, in South Florida, we are the title fraud capital of the world. So, nothing surprises me anymore,” according to Marty Klar, Broward County’s property appraiser.

In one bold and elaborate case, criminals filed civil lawsuits mainly against the elderly, low-income homeowners, banks, and others to falsely claim they owned property. They then received property titles through identity fraud or by saying they were uninhabitable or abandoned.

In cases involving bank-owned properties, such as U.S. Bank, Deutsche Bank, and Bank of Mellon, the criminals sued the banks and then authorized a person in their gang as the bank’s agent who could receive paperwork on behalf of the banks.

The gang member then filed fake papers allegedly from the bank that said the bank was not interested in owning the properties anymore. This then allowed the criminals to assume ownership of the properties eventually. Otherwise, the fraudsters never followed the needed court documents. In these cases, the banks never knew they were involved in any lawsuits.

Why Fraudsters Love Florida

Since the 1920s flurry of land speculation in Miami, Florida, has been perceived as a place where the fountain of youth, combined with affordable tropical living, has attracted retirees from colder environs. But this alone does not explain why fraud and deceptive business practices have become so ingrained in Florida’s commercial DNA.

According to attorneys and fraud experts, Florida’s deceptive business practice situation results from its lax consumer protection statutes, poor law enforcement, old-boy political network, complex legal structure, and caveat-emptor history.

“The biggest contributing factor to Florida’s large number of fraud complaints is its loosely enforced consumer protection laws, which make it easy for fraudsters to take advantage of unsuspecting victims,” Andrew Pickett, a trial attorney in Melbourne, Florida, said. “Florida systemically ranks in the top five for fraud complaints because of its abundant resources, freewheeling atmosphere, and lack of oversight that can lead to an influx of fraudulent activities.”

“Florida’s Wild West culture and political structure also create an environment for fraudsters to exploit the system. For instance, he added that the state’s corporate partnership laws and its more relaxed approach to business regulation could sometimes enable fraudsters to operate with less supervision.

Florida is No Friend of Consumers

Over the years, Florida has developed an overlapping, complex set of laws and regulations that benefit fraudsters, ranging from identity thieves to unlicensed contractors. In many cases, even well-meaning law enforcers are overwhelmed by the avalanche of fraud reports.

“Florida has relatively lax and lenient regulations regarding consumer protection,” according to Min Hwan Ahn, a New York attorney.”With many fraud cases, it can be challenging for Florida’s law enforcement agencies to effectively tackle and investigate all reported instances. This could result in delayed or insufficient action, providing fraudsters more opportunities to continue their illegal activities.

This is more complex because Florida has “a unique mix of federal, state, and local laws, which could sometimes create ambiguity or loopholes that fraudsters can exploit. To address this issue, clarity and consistency in the legal framework could strengthen anti-fraud efforts and create a greater deterrent effect,” Hwan Ahn added.

There is also the issue of demographics. Florida is the third most populous state in the U.S., which means there are more potential targets, especially its many elderly residents, according to Robert Siciliano, CEO of ProtectNowLLC.com. Many of the elderly monied and retired, and Siciliano said, “Scammers target older individuals who may be more vulnerable or trusting FaceTime the way they were raised to respect authority.”

He also noted that Florida has many part-time residents, tourists, and others who are not native English speakers. “Transient-type populations can make it easier for scammers to operate without drawing attention, as they can easily blend in with tourists,” Siciliano said.

“In many communities with an established population, we like to get referrals from friends; sometimes they are good, and something bad,” L. Burke Files, a Tempe, Arizona-based financial fraud investigator for 30 years, said. Florida’s long history as fraud capital has also created “fraud schools,” Files said.

“There is also a great deal of organized crime in South Florida. Those guys who are in the rackets learn from each other. One specializes in Medicare, another in fake stock promotions, another in online scams, and they teach those around them. This has been going on for decades. This is reminiscent of the adage of specialization: some communities are good at building furniture, and some are good at stealing furniture,” Files added.

No Accountability by Florida Agencies

There is also the overarching factor of politics. “A political structure that lacks transparency, accountability, and effective regulation can create an environment where fraudsters can operate with relative ease,” according to Nicolas Harrish, “If political institutions are compromised or lack the necessary checks and balances, it may enable fraudulent activities to persist.”

According to Michael Ryan, a financial planner, and Florida resident for 25 years, Florida’s “buyer beware” legal system “places the burden of verifying information on consumers, making it easier for fraudsters to deceive unsuspecting individuals who may not have the resources or expertise to validate the accuracy of sellers’ claims.”

Experts also argue that Florida’s political structure favors business-friendly policies over stringent regulation and enables fraudulent activities. “This lack of oversight allows fraudsters to operate with relative impunity,” Ryan said.

Preying on Average Citizens

Average Floridians are targets of fraudsters but often involve smaller amounts. Many of these involve home improvement and construction projects.

As a state that boasts about its “freedom,” this also means that unlicensed contractors operate freely. “In Florida, a person involved in contracting must be certified, licensed, or registered for the specific areas of the work being performed,” according to the Upcounsel website.

While delivering services as an unlicensed contractor is against the law, local officials rarely enforce it. “There are nine ways a person can be in a position to commit a crime by being an unlicensed contractor in Florida,” according to the Upcounsel law firm.

The site also said, “Unlicensed contractors generally do not offer a contract, nor do they have lien rights.” And while most homeowners don’t know this, the law firm said, “legally, you are not obligated to pay an unlicensed contractor.”

However, because unlicensed contractors are cheaper than licensed ones, homeowners frequently hire them without obtaining the necessary permits. This can mean shoddy work that fails to comply with local building ordinances, loss of permit revenue to localities, and homeowners with fewer ways to recover payments for poor workmanship.

As an employee in a large home improvement center in South Florida, I have spoken with thousands of homeowners, renters, and contractors about what went right—and wrong—in their projects.

Both groups had many stories about deceptions, poor workmanship, and paying for services and products that were never delivered. One contractor with 25 years of experience in Delray told me that half of his work is to correct the mistakes of other contractors. One retired contractor from New York bought a condo and discovered the air conditioning system was not fully operational. He then went into the attic to discover that two main ducts were never connected. He told me the condo was previously owned by an invalid who could never have fixed the problem.

I also noticed that older women were buying expensive, professional electrical testing equipment and special tools used by electricians and plumbers. When I asked why they were buying them, they told me their handyman told them to. When I asked if they were being reimbursed for buying the expensive tools, they looked at me with a blank stare. Many told me they never thought of getting reimbursed. They thought it was part of the project.

When another elderly woman told me she was remodeling her kitchen for the second time in five months because the previous contractor took her money and never finished the job, I asked her if she was going to try and get her money back. She said it was too much for her to do. Her answer was unsurprising since 90% of white-collar frauds go unreported.

Unlicensed contractors in Florida are common and pose a challenge for homeowners and homeowner associations. Even something as straightforward as screen installation can pose problems. In Palm Beach County alone there were about 44 licensed and 44 unlicensed contractors doing business, as of November 2022. The burden is on homeowners to find out who is insured or not since this can affect their remedies in the event of faulty workmanship.

Where are the Florida Fraud Enforcers?

As the third state to join the Confederacy in 1861 and a strong right-to-work anti-union state, Florida has not vehemently prosecuted white-collar crimes.

“The Florida criminal justice system has consistently treated white-collar crimes as less critical than conventional crimes despite the financial and emotional impact on victims and society. Citizens of Florida encounter a maze of difficulty when trying to find which government agencies handle complaints and investigations on white-collar crime cases, Crystal T. Broughan, a fraud attorney in Jacksonville, Florida, wrote in a 1996 report, Florida’s Approach to White Collar Crime: Coordinated or Chaotic?

A local sheriff reiterated this view: “Florida has a fragmented and inefficient approach to investigating white-collar crimes. White-collar crime victims do not bleed, so white-collar crime is not a priority for local law enforcement,” Sgt. J. Layman, Broward County Sheriff’s Office, said on Oct. 30, 1997.

Florida Governor Ron Desantis has not changed the state’s tradition of being pro-corporate, anti-consumer, and open to bestowing political favors to cash donors.

It has also created a pro-crony political environment, attracting the wealthy nationwide who want “freedom” from the state’s favorable tax rates and pro-business regulations. This has attracted real estate developers, private equity, and hedge fund execs who can pay lower state taxes while enjoying their carried interest tax loopholes at the federal level.

The attraction of sun and fun has also attracted shady foreign politicians and mobsters to Florida. Former Brazilian President Jair Bolsonaro slipped out of Brazil and into Orlando. Meyer Lansky lived in Miami for decades. John Gotti (the late boss of the Gambino crime family) and Nicodemo Scarfo (the boss of the Philadelphia crime family) both owned homes in Fort Lauderdale. The “King of Cocaine,” Pablo Escobar, had a house in Miami, while “Cocaine Godmother,” Griselda Blanco, had a penthouse in Biscayne Bay.

The Sunshine State also included serial molester Jeffrey Epstein and tax evader Donald Trump among its residents. Today, gangsters from Russia, Israel, and South America have expanded their gambling, money laundering, drug business, and internet frauds to Florida.

However, this is all an extension of an old Florida tradition. Al Capone got a hardy welcome in the Sunshine State when he wanted to buy a $40,000 estate in Palm Springs, Florida. But, due to his reputation, his plans to buy a home were unanimously rebuffed by local officials who voted to prevent him from taking residence. But in true Florida form, the mayor of Palm Springs ignored the decision and even went one step further: He allowed his real estate firm to sell Capone the house. That was in 1928. Things have not changed much since then.